Get the free ohio tax exempt form

Show details

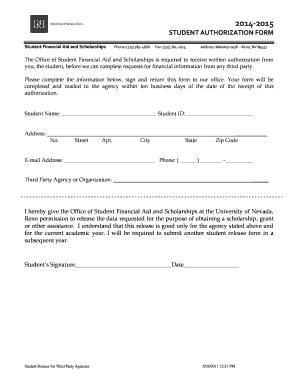

This document allows purchasers in Ohio to claim exemption from sales tax for tangible personal property and selected services, specifically for purchases made by Ohio University under the exemption

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt form ohio

Edit your ohio sales tax exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

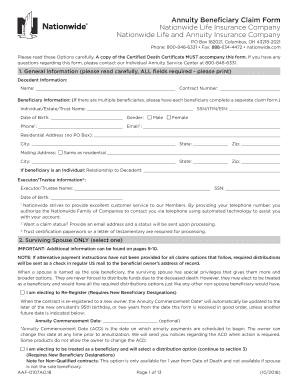

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of ohio tax exempt form online

Here are the steps you need to follow to get started with our professional PDF editor:

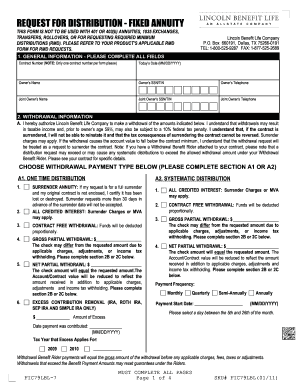

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what does a tax exempt certificate look like form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt form ohio pdf

How to fill out irs tax exempt certificate:

01

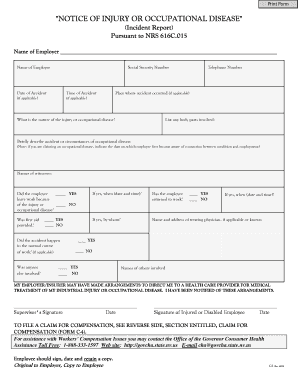

Obtain the correct form: The first step is to obtain the appropriate IRS tax exempt certificate form, which is usually Form 1023 or Form 1024. These forms can be downloaded from the IRS website or requested by mail.

02

Provide organization information: Fill out the form with the organization's basic information, such as the legal name, address, and contact details. Ensure accuracy and completeness of the information provided.

03

Determine the tax exemption category: Choose the appropriate tax exemption category that matches the organization's purpose and activities. Some common categories include religious, charitable, educational, and scientific organizations.

04

Provide detailed explanation: Describe the organization's activities, purpose, and how it meets the requirements for tax exemption. Include information about programs, services, and any financial implications.

05

Attach supporting documents: Support the application with necessary documentation, including financial statements, articles of incorporation, bylaws, and any other relevant records. Make sure to include all required attachments specified on the form.

06

Pay the filing fee (if applicable): Some organizations may need to pay a filing fee along with the application. Check the instructions on the form to determine if a fee is required and the payment methods accepted.

07

Review and submit: Review the completed form and all attachments for accuracy and completeness. Once satisfied, submit the form to the IRS according to the instructions provided. Retain a copy of the submitted form and any supporting documents for future reference.

Who needs irs tax exempt certificate:

01

Nonprofit organizations: Nonprofit organizations such as charities, foundations, religious organizations, and educational institutions often need an IRS tax exempt certificate to establish their tax-exempt status.

02

Social welfare organizations: Organizations that operate to promote community welfare, such as civic leagues, social clubs, and volunteer fire departments, may also need an IRS tax exempt certificate to qualify for tax exemption.

03

Business leagues and chambers of commerce: Trade associations, professional organizations, and chambers of commerce may require an IRS tax exempt certificate to enjoy tax-exempt status and provide additional benefits to their members.

Note: It is essential to consult with a qualified tax professional or attorney to understand the specific requirements and process for obtaining an IRS tax exempt certificate for a particular organization.

Fill

tax exemption certificate

: Try Risk Free

People Also Ask about ohio sales tax exempt form

What does it mean when you put exempt on your tax form?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

What does IRS tax-exempt mean?

A "tax-exempt" entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

What is the number for Florida tax exemption?

If you have any questions about the application process, call the Exemption Unit of Account Management at 800-352-3671, Monday – Friday, 8:00 a.m. to 5:00 p.m., ET.

How do I look up a Florida tax-exempt certificate?

Phone: 877-FL-RESALE (877-357-3725) and enter the customer's Annual Resale Certificate number. Online: Go to the Seller Certificate Verification application and enter the required seller information for verification.

Is the resale certificate the same as the tax exempt certificate in Florida?

A Florida resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

Do I claim myself as an exemption on w4?

“Should I declare myself exempt from withholding?” No, it's not a good idea to claim you're exempt simply in order to get a bigger paycheck. By certifying you are exempt, your employer wouldn't withhold any federal income tax amounts during the year, and that would result in a large tax bill due in April.

What federal tax form do I need to file exempt?

To claim exempt, you must submit a W-4 Form.

How do I fill out a W 4 exempt form?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample tax exempt certificate to be eSigned by others?

Once your ohio tax exemption certificate is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the tax exempt certificate example in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tax exempt form example right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit ohio sales tax exemption certificate on an Android device?

You can edit, sign, and distribute blank tax exempt form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is what does a tax?

A tax is a mandatory financial charge imposed by a government on individuals and businesses to fund public services and governmental operations.

Who is required to file what does a tax?

Individuals and businesses that earn income above a certain threshold are required to file a tax return. This includes employees, self-employed individuals, and corporations.

How to fill out what does a tax?

To fill out a tax return, you need to gather your income information, deductions, and credits, and use the appropriate tax forms provided by the government. Follow the instructions for the form and ensure that all information is accurate.

What is the purpose of what does a tax?

The purpose of a tax is to generate revenue for the government to fund public services such as education, healthcare, infrastructure, and social programs.

What information must be reported on what does a tax?

Tax filers must report their income, applicable deductions, tax credits, and any taxes already paid, such as withholding from paychecks.

Fill out your ohio tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Form is not the form you're looking for?Search for another form here.

Keywords relevant to state of ohio sales tax exemption form

Related to sales tax exemption certificate ohio

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.